Depiction of an Arabian businessman,

Visual Art Studio, Adobe Stock

Part VI

Dances with Wolves: Israel and Iran

by Brian Broberg | October 14, 2024 | Estimated read time: 17 minutes

In Part V, we covered the next steps for Israel and what it might look like for them to defeat Iran. The bottom line is Israel must become independent of their neighbor’s attacks, harassment, and threats. More importantly, they must stop Iran’s nuclear weapons capabilities. Since diplomacy and appeasement are futile in this region of the world, the storms of war are the only option. Iran’s regime (not the Iranian people) will become the hunted. The Lion of Judah will scout out the wolf’s lair…and take him out. This doesn’t mean a land invasion, but rather the tactics outlined in Part V. Of course, these actions, whether they occur in part or in whole, will have implications for the markets. It is important that we go into this with our eyes wide open, so I will address those first, even though the potential outcomes are completely unpredictable. Then, I’ll set aside Israel’s possible actions and take a look at what we know about the geopolitical situation and the US economy. This discussion will drive my conclusions about the outlook for the stock and bond markets.

The Elephant in the Room

Any Israeli attack on both the Iranian regime and its nuclear warfare development activities will likely get a swift reaction by the market. This is the elephant in the room and investors want to know what happens to their portfolios if this occurs. Even the Biden administration is concerned. To allay some of Israel’s response to the October 1 Iranian missile attack, the US tightened oil sanctions against Iran on October 11.[i] Based on the recent past, I don’t think this will sway any of Israel’s military decisions or lessen their severity. Of course when Israel strikes, it will appear that Wall Street doesn’t like what they observe about the unfolding events—at least, for a bit. Likely, traders will unemotionally take advantage of everybody else’s fears and hit the sell button to drive stock prices down. Whatever decline may result—5, 10, or 15%—it will likely be quick, steep, and short-lived. Why? Because these same traders know three things, while “Ma and Pa Kettle” are scared out of their wits.

The first is that Israel will well be on their way to removing a major obstacle to regional peace in the Middle East. Their actions serve Western interests, despite the West’s fears of escalation and a wider war, as they define those. The Israelis will do the dirty work of removing a regime bent on global rule and all the instability that causes for a region the ayatollahs must first gut. They won’t have that opportunity, at least not for a very long time. (Yes, I can produce some incredibly pessimistic alternate responses and scenarios after an Israeli attack, but it is impossible to game them out. Even Clausewitz said, “No campaign plan survives first contact with the enemy.” To be clear, I have no predictions, because after the first missile is launched, the attack plan goes out the window.)

Second, who will come to Iran’s aid, and thereby “expand” the war? Yes, Iran, Russia, China, and North Korea are allied together to end US leadership and advantage in the world. But really? Russia is committed to stealing Ukraine, so they are a little busy right now. China bought a used Russian-made aircraft carrier from Ukraine (whose sister ship, the Russians can’t sail without a repair ship close by and has been dry-docked for years due to operational issues) and their newest attack submarine just sunk while tied to the pier a couple of weeks ago. So, no. What about the Hermit Kingdom, North Korea? Uh, no. So again, no expansion beyond the current pack of wolves.

Lastly, these same traders know that the US economy is strong so they will likely buy back what the Kettles sold at lower prices. This is why I believe a reaction by Wall Street will be short-term in nature. The rest of this article will discuss the things that impact the market in the long term. And I’ll make the case that the intermediate period looks positive. Let’s start with the big picture, by setting aside Israel’s potential actions for a moment.

The Geopolitical Situation

As you know, the focus of this six-part article is the war between Israel and Iran, but to discuss what their conflict means for the markets, we must not forget about the wolves in Russia and their war on Ukraine, as well as circumstances in the South China Sea. Both of these situations mean something for the markets, but in different ways.

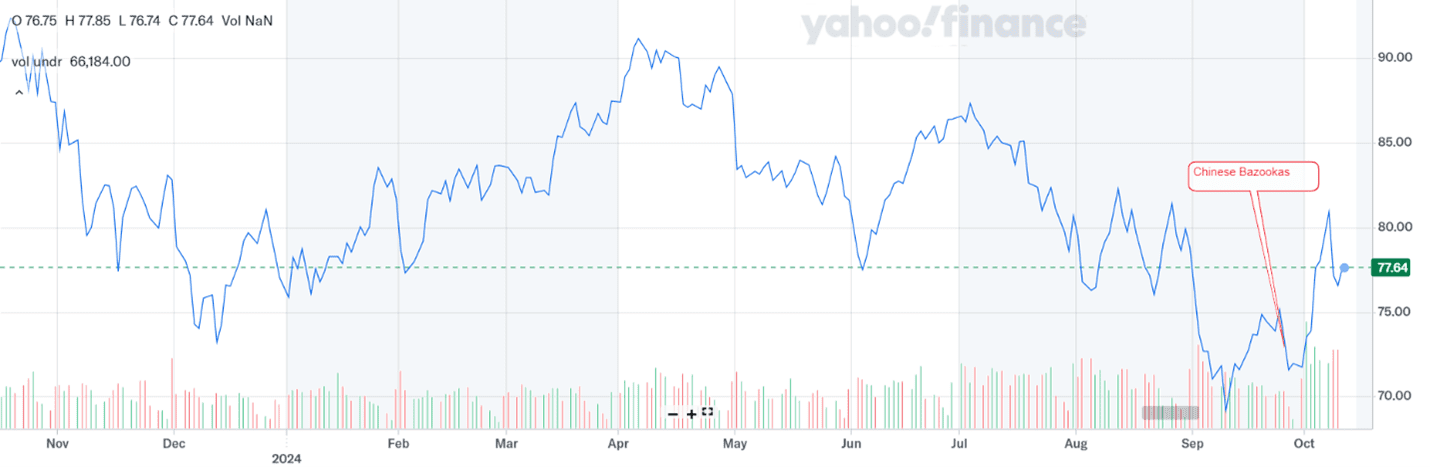

Let’s start with Russia. Although this war in eastern Europe is important, I’m only going to address it tangentially, as it relates to oil prices. Russia and OPEC[ii] share a common interest in higher prices. But at the moment, Russia needs the cash flow more than it needs higher revenues. So, they’ll keep pumping, even if they get less money for it. But that means they can’t afford to cut production to force prices higher. The majority of the other oil exporters (OPEC+), however, agreed to terms for overall cuts on June 2, 2024. This was no surprise. The oil markets knew this cut was coming. For context though, see the chart below, which shows a 1-year period.

You’ll observe that Brent Crude oil price closed at $84.58 per barrel on October 6, 2023, the day before Hamas attacked Israel. About two weeks later, on October 19, it hit a high of $92.38. We haven’t seen that price since. Although oil prices have meandered between $73 and $91 since then, and despite OPEC’s production cuts in June (to move prices higher), they hit a new low price for the year at $69.19 on September 10. This is uncanny when considering two wars in regions where combined most of the world’s oil production occurs.

Brent Crude Oil Futures Price—1 Year

Given the election year, the US Administration wants to see inflationary pressures kept at bay, if not continue to decline. It helps that US oil production is at full speed to meet not only its customers’ demand, but to help keep Europe’s oil tanks topped-off. Europe’s needs met creates the corresponding benefits of shutting off (even if not perfectly) a market for Russia and keeping prices from getting out of hand.

Besides the US oil supply, what else explains lower oil prices? Two factors are clear. First, lower oil prices usually indicate reduced demand for oil. This is evident as both the Chinese and European economies are currently slowing down. Germany, the economic engine of Europe, is near recession, and it wouldn’t be surprising to see China in a recession by early next year. These are the second and third largest economic regions in the world, and if they are slowing, then demand for oil will fall.

That said, there is a little spike in oil prices at the end of the chart, starting on September 26. Two days before, China fired two “bazookas.” Recognizing their economic troubles, the People’s Bank of China (PBoC) did what any worthwhile central bank would do. They cranked up the money “printing press.” Simultaneously, the Chinese Communist Party (CCP) went into beast-mode with new spending programs. The global markets loved these moves by China, but there are questions about whether or not it will work. The other reason for the spike was, of course, the emotion surrounding Iran’s second missile attack on Israel on October 1. But as you can see at the end of the graph for mid-October, prices may already be moderating because of doubts about the success of China’s stimulus packages. So, we’ll see.

When thinking about the moderation of oil prices the last year, despite two wars, there is another factor to consider. The world’s experts who follow and trade in the oil markets are not anticipating an expansion of hostilities beyond the current players and regions. In other words, there is no World War III—or whatever you want to call it. At least that is the present calculus. If hostilities spread or if another war springs up somewhere else, the oil prices will not stay at the lower end of the current trading range. If anything, they’d move up and out of the range. That means that the oil market recognizes that, yes, the wolves are running, but they aren’t attracting other predators—for now.

For the time being, these are the most important factors that explain why oil is lower and that makes the outlook for the US market positive.

The second geopolitical concern is found in the South China Sea.

Most people know that China is keen to reincorporate Taiwan back into its fold. China doesn’t recognize Taiwan’s independence and makes their future plans for them clear. I’m not going to elaborate, but suffice it to say, a threat to Taiwan is a threat to the United States. China is willing to go to war to overthrow Taiwan’s rightfully posted government and ensure that the country once again bows down to Beijing. But for now, they are satisfied with illegal military overflights and navy demonstrations along their coast. I don’t anticipate the ignition of true hostilities in the short-term, but when they come, the United States must be prepared. So, there is no real market impact to specify for now, nor can it be predicted.

But have you heard about the Chinese Navy’s ramming and harassing of Philippine Coast Guard vessels in the South China Sea? These are violent and provocative, and completely denied. In fact, propaganda is immediately disseminated blaming the Philippines for these altercations. Of course, we all know the truth. On September 15, a crew from 60 Minutes witnessed these actions first-hand. They were sent there to report on what the Chinese are doing (and have been doing for two years) in Philippine territorial waters.[i] The ship the journalists visited, the Cape Engaño, was rammed by a Chinese vessel twice its size, in the middle of their first night. The following morning their ship was surrounded by fourteen Chinese warships. Whoa! Now that’s a wakeup call. Why is this so important?

It’s simple. The United States has a mutual defense agreement with the Philippines. At what point do the Chinese provocations demand a US response? Perhaps this means that the Philippines takes the limelight, not Taiwan.

Again, time will tell. But isn’t it interesting how things are ratcheting up at various locations around the world? Again, this doesn’t mean World War III. Let’s realize, though, that the Chinese are probing the seas they want to control to see who reacts and how. I don’t think they are attempting to start a war. Why not?

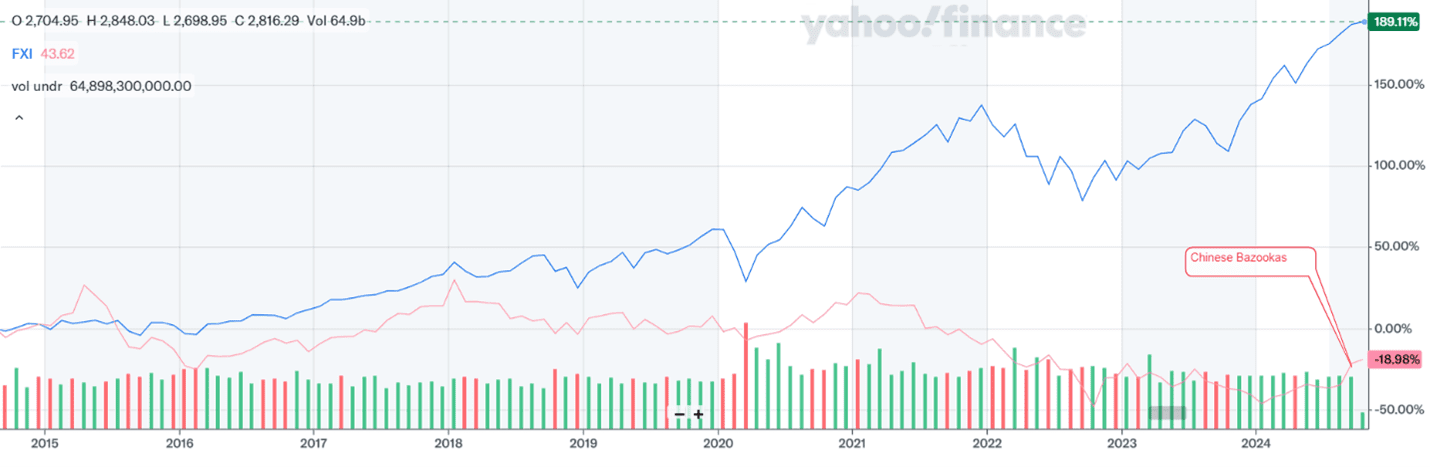

Because they have bigger problems at home. Their economy stalled and all you have to do is look at their stock market to see it. The chart below is a comparison between a US large company index of stocks, the S&P 500 (the blue line), and a Chinese large company index (the red line), over the last ten years. The US market is up significantly. China’s is down and negative. Surprising, isn’t it?

S&P 500 vs. Chinese Large Cap Index—10 Years

For ten years, the economic competition between the United States and China isn’t even close. Other measures also prove the point. Chinese consumer confidence is at 34-year low, their home prices decreased over the last three years, and China’s GDP growth could turn negative early next year. Their weakness, as mentioned before, is weighing on crude oil prices and the prices for other commodities. To add insult to injury, their two-child policy (which was once an even more foolish one-child policy) isn’t adequate to provide the workers they are going to need to work their future.

Thus, the firing of two bazookas. They caused an immediate positive reaction in the markets, but there are many questions about sustainability—too many to address here.

Looking at this graph above makes me think, “So much for the Chinese taking over the world.” (I never bought that thesis anyway.) This chart might be all the evidence we need. Even hedge fund titan, Ray Dalio, and Larry Fink, chairman and CEO of BlackRock, have recently backed off their bullish calls for the Chinese market. Besides, in the end, do evil regimes ever take over anything? Did the Soviet Union? That’s what I thought.

For now, these are the geopolitical situations that are getting the most attention. But overall, I don’t think we have to hit the panic button, even though many online sources will tell you the sky is falling. I don’t think so.

That leaves the US economy. What can we expect from the American economic engine?

The US Economy

Let’s start by discussing inflation, interest rates, and the latest action by the Federal Reserve.

The current price action in the oil pits can contribute positively to the inputs for calculating inflation. A declining oil price is good for future inflation expectations. Even if oil stays within its trading range, the Federal Reserve is not likely to raise interest rates. Earlier in the year, the market struggled over questions about inflation and speculated that the Fed may raise the Federal Funds Rate again. That didn’t seem realistic to me, but time would tell. As it turned out, the inflation rate, with a few scares along the way, has come down enough for the Federal Reserve to claim victory. Their goal was to get inflation down to a 2% growth rate, and although the headline number hasn’t reached that measure, there are many indicators that are below that rate. Now the Fed is comfortable that the CPI number will reach its target and has turned their attention to other factors.

One factor is the unemployment numbers. They bottomed earlier in the year and are now rising, even if only slightly. But it is enough for Jerome Powell to change course and prevent unemployment from moving any higher, or worse yet, jumping higher. So, he effectively stepped on the economy’s gas pedal. And of course, as you know, the Fed started decreasing rates on September 18, by a whopping half percent. That is a big move and only the start of the rate decreasing campaign that will go long into 2025 but, perhaps not as fast as the market would want.

And alas, the Fed decision was made in mid-September, before the jobs report on October 4, which showed the unemployment rate fell further, and payrolls reached a new record. So much for a deteriorating employment picture. (The market rallied.) Then the inflation data on October 10 implied that inflation was heating up again. (The market yawned, then set new highs on Friday, October 11.) As it turns out, the Fed may have jumped the gun. Although the bond market, as represented by the 10-year Treasury yield (see chart below), signaled all summer that they saw the Fed lowering rates this year, it reversed course right after the Fed lowered rates, indicating a concern that inflation wasn’t coming down fast enough. The bond market can be fickle, but it does show the possibility of the Fed taking no further action on rates (known as, “once and done”) until after the new year.

10-Year Treasury Note Yields for prior 12 months

The fact is the economy is doing well. The latest GDPNow[i] measurement shows economic growth at 3.2% as of October 9. On a $29 trillion economy, that’s excellent. In addition, for the second quarter, corporate profits were at all-time highs. These two factors are the most important overall. Despite what politicians are saying, the economy is doing fine, and that’s despite Washington’s shenanigans and dysfunction. From this perspective, the markets can move higher and likely will between now and the end of the year, even if most of the move has already taken place.

That leaves other short-term factors. I already addressed oil prices, but a second important factor is manufacturing in the goods sector. This component of the economy is in recession and has been since early 2022, when the pandemic restrictions started to lift.

“But I thought you said the economy is growing?” you might ask. Well, the overall economy is growing, and that is showing up in the GDP numbers. But that doesn’t mean that there aren’t parts of the economy that are less than robust. The goods economy took off during the pandemic because people spent money while stuck at home. When the economy opened up, much of that spending reversed. Instead of “stuff,” they shifted their spending to “experiences.” They hopped on cruise ships, planes, trains, and automobiles. This is why travel and destination spending spiked upward. And it is still relatively strong. People got out to experience the world, instead of the four walls of their bedroom office. To put some meat on that, the global airline index is up some 30% for the last twelve months. Not bad.

So, this third factor, this sometimes-overlooked spending shift, along with other spending patterns, has helped the economy to maintain its strength. With these things in mind, we’ll turn our attention to the markets themselves.

Stock and Bond Markets

I have discussed the geopolitical situation and much of what it entails. And I’ve demonstrated the strength of the US economy. It is likely that these will not devolve, even if Israel strikes Iran the way I think it should (because it likely will still be contained within the same region and players, as it has the last twelve months). Therefore, the outlook for the market is still positive. Yet, there are always crosscurrents in the short-term.

Despite the all-time new high for the markets on October 11, these crosscurrents will likely keep US markets in choppy waters through the election. Although the direction for short-term interest rates is down, the speed of that decrease is still up for debate, as is the outcome of the US election. Normal seasonal trends will also play a role in shaping the markets. US economic strength, however, is the counter to these crosscurrents, which could keep the markets in an upward tilt. This is my base case, which I think will be correct.

The best case for the markets is that the Fed lowers rates again, which may add fuel to the market’s fire. I hope they don’t because the Fed could also cause a “melt-up” in stock prices. We’d feel great about that, but overly exuberant markets don’t normally end well. And what about my worst case? If inflation does not continue to moderate, causing the Fed to pause the rate cuts altogether, perhaps even reversing course by raising them (God forbid), this could easily send the markets into full correction mode. I assign this latter case an exceedingly small probability.

As for the bond market, I expect treasury note yields (a proxy for the bond market and mortgage rates) for the next six months or so to remain in a range between 3.5 and 4.5%. This is dependent upon the timing of rate cuts and risks associated with the Middle East. On the whole, the treasury bond market is more sensitive to big macro issues, such as national debt and deficits, wars and rumors of wars, and the like. I am aware of these and watch them, but their consequences and tipping points are neither certain nor predictable. It’s almost senseless to think about them too much but we can’t ignore them either. The key for investors, though, is not to make investment decisions about them, at least not on this day. One will either take too much risk, or not take any risk at all. Neither is a long-term winning strategy.

Let’s see where we are in December, but I expect higher highs by then, despite what may be the case in the interim.

Thank you for parting with your time and reading this rather long six-part piece. Although it was a lot of work, I enjoyed the research and the writing. Your feedback or questions are always welcome, so please drop me a line at brian@broberginvestmentgroup.com .

In the meantime, enjoy the great outdoors and some beautiful autumn evenings with the refreshing night air.

[i] Nancy Youssef and Michael Gordon, “US Tightens Oil Sanctions on Iran as It Seeks to Contain Israeli Attack,” Wall Street Journal, wsj.com, October 11, 2024, https://www.wsj.com/world/middle-east/u-s-tightens-oil-sanctions-on-iran-as-it-seeks-to-contain-israeli-attack-dd983191?mod=Searchresults_pos1&page=1

[ii] Russia is in a group called OPEC+ but is not a member of OPEC.

[iii] https://www.youtube.com/watch?v=V80MGYrWWaM

[iv] Federal Reserve Bank of Atlanta, GDPNow, www.atlantafed.com . GDP is gross national product and measures the economic output of the nation, as well as its growth rate.